This manual focuses on the critical project-related activities such as work breakdown, scheduling, cost control and risk management.

Revision 6

Website: www.idc-online.com

E-mail: idc@idc-online.com

IDC Technologies Pty Ltd

PO Box 1093, West Perth, Western Australia 6872

Offices in Australia, New Zealand, Singapore, United Kingdom, Ireland, Malaysia, Poland, United States of America, Canada, South Africa and India

Copyright © IDC Technologies 2012. All rights reserved.

First published 2002

ISBN: 978-1-921716-54-6

All rights to this publication, associated software and workshop are reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means electronic, mechanical, photocopying, recording or otherwise without the prior written permission of the publisher. All enquiries should be made to the publisher at the address above.

Disclaimer

Whilst all reasonable care has been taken to ensure that the descriptions, opinions, programs, listings, software and diagrams are accurate and workable, IDC Technologies do not accept any legal responsibility or liability to any person, organization or other entity for any direct loss, consequential loss or damage, however caused, that may be suffered as a result of the use of this publication or the associated workshop and software.

In case of any uncertainty, we recommend that you contact IDC Technologies for clarification or assistance.

Trademarks

All logos and trademarks belong to, and are copyrighted to, their companies respectively.

Acknowledgements

IDC Technologies expresses its sincere thanks to all those engineers and technicians on our training workshops who freely made available their expertise in preparing this manual.

Contents

Chapter 1 – Fundamentals 1

1.1 Definitions 1

1.2 Project Management 2

1.3 Project Life Cycle 4

1.4 Project organizations 6

1.5 Project success 11

1.6 Project planning 13

Chapter 2 – Time Management 23

2.1 Project Planning 23

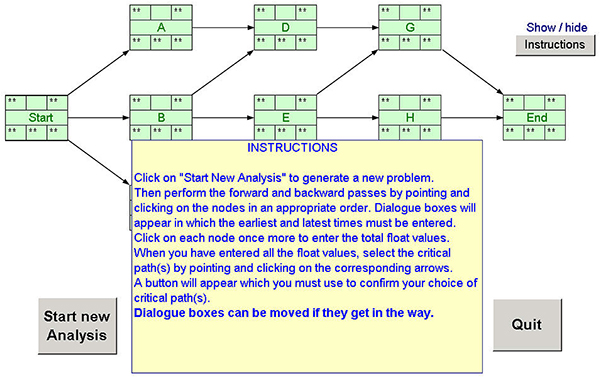

2.2 The critical path method 24

2.3 The precedence method 31

2.4 Presentation of the scheduled network 34

2.5 Analyzing resources requirements 35

2.6 Progress monitoring and control 37

2.7 Software selection 39

Chapter 3 – Cost Management 41

3.1 Cost estimating 41

3.2 Estimating methods 42

3.3 Forecast final cost 43

3.4 Documentation of estimating procedures 43

3.5 Budgeting 43

3.6 Financial control 44

3.7 Change control 45

3.8 Cost reporting 47

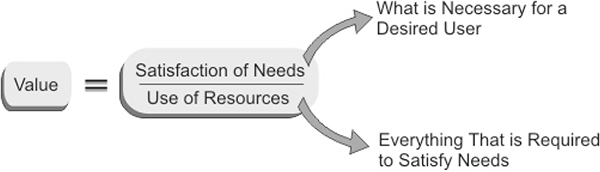

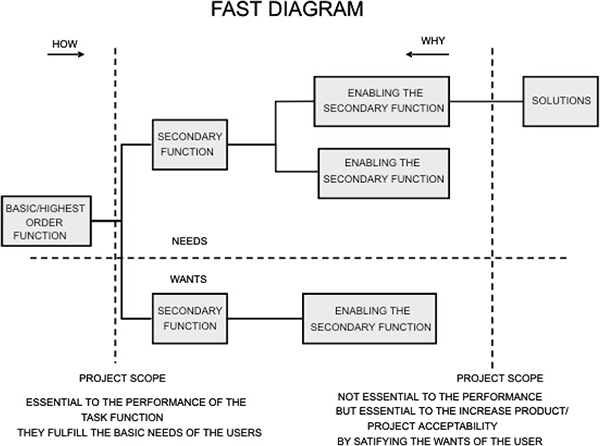

3.9 Value management 48

Chapter 4 – Risk Management 49

4.1 Definition of ‘risk’ 49

4.2 Risk management 50

4.3 Establishing the context 51

4.4 Risk identification 52

4.5 Risk analysis 53

4.6 Risk evaluation 58

4.7 Risk treatment 59

4.8 Monitoring and review 60

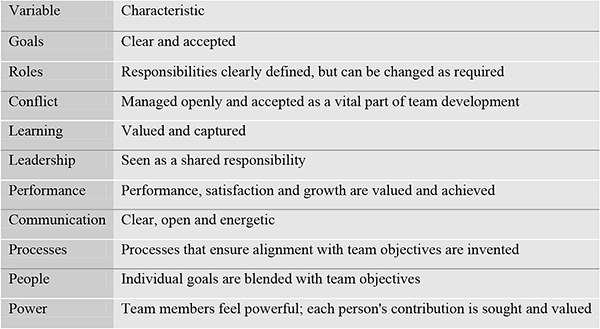

Chapter 5 – Quality Management 65

5.1 Quality and quality management basics 65

5.2 Quality assurance systems 71

5.3 ISO 9000:2005 Quality System guidelines 72

5.4 Project quality assurance 73

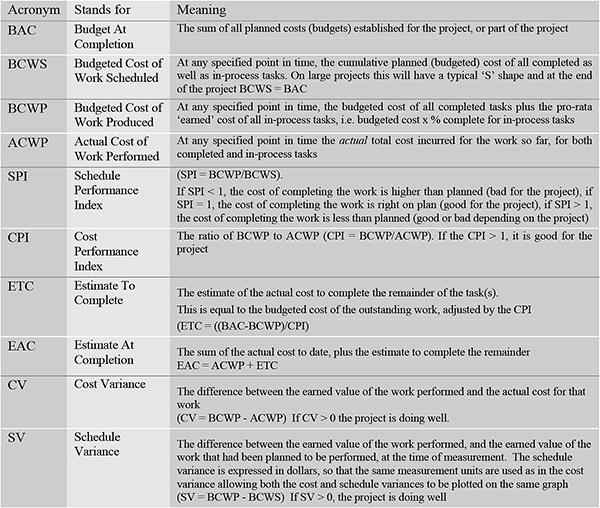

Chapter 6 – Integrated Time and Cost Management 77

6.1 Earned value analysis 77

6.2 EVM analysis illustrated 79

6.3 Computer based integrated time and cost control 81

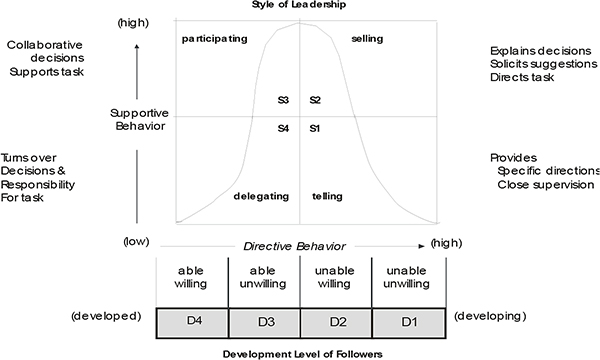

Chapter 7 – The Project Manager 83

7.1 Management and leadership 83

7.2 Cultural influences on project management 86

7.3 Authority and power of the project manager 90

7.4 Required attributes of the project manager 91

7.5 Essential functions of project managers 91

7.6 Selection of the project manager 92

Chapter 8 – Contractual Issues in Procurement Contracts 95

8.1 The Commonwealth legal system 96

8.2 Elements of contracts 97

8.3 Procurement strategy issues 101

8.4 Tendering 104

8.5 Vitiating factors 105

8.6 Termination of contracts 106

8.7 Time for completion and extensions of time 108

8.8 Remedies for breach of contract 111

8.9 Liquidated damages for late completion 112

8.10 Penalties and bonuses 112

Chapter 9 – Exercises 115

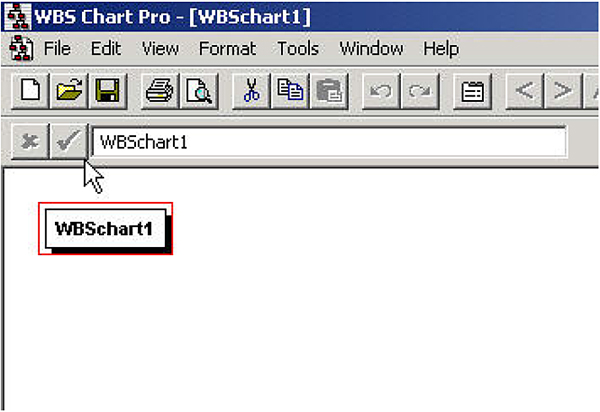

9.1 Work breakdown structures 115

9.2 Time management 115

9.3 Cost management 116

9.4 Integrated time and cost 121

9.5 Quality management 123

9.6 Risk analysis 125

9.7 Contractual issues 126

9.8 Project quality plan 128

Chapter 10 – Solutions 129

10.1 Work breakdown structures 129

10.2 Time management 134

10.3 Cost management 143

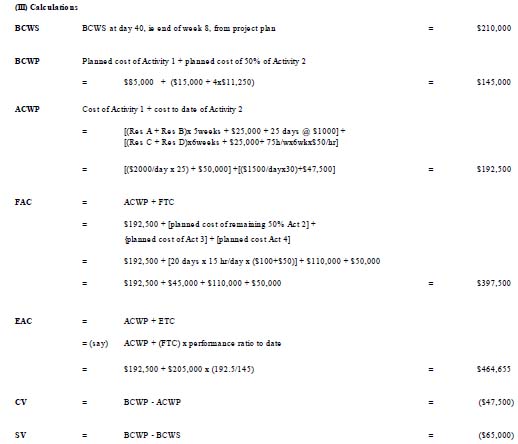

10.4 Integrated time and cost 145

10.5 Quality management 147

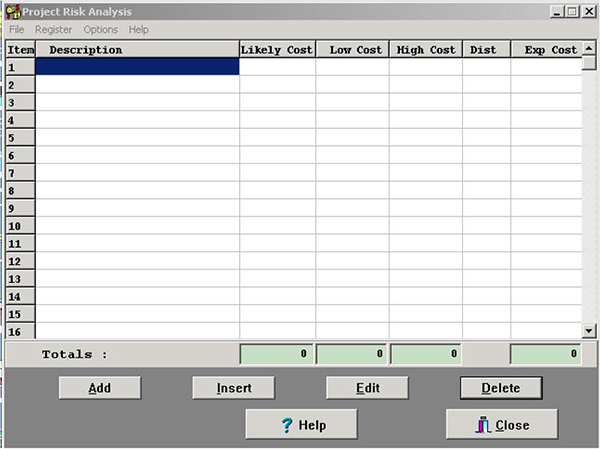

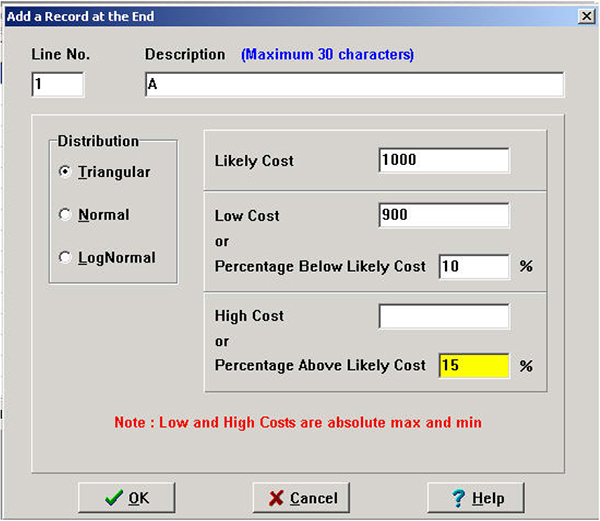

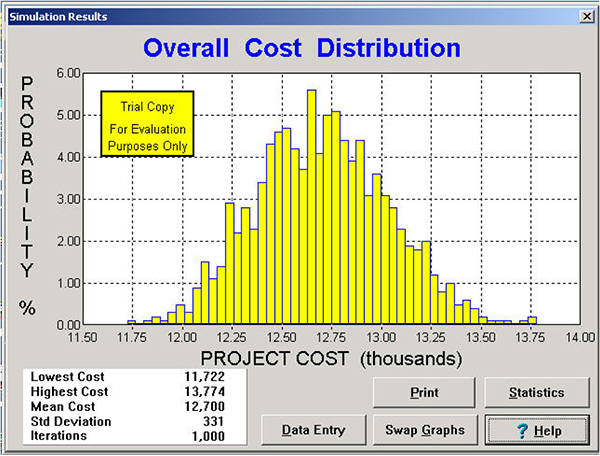

10.6 Risk analysis 147

10.7 Contractual issues 151

10.8 Project quality plan 152

Appendix A – Budgets, Variance Analysis, Cost Reporting and Value Management 155

Appendix B – Cost Estimation Methods 211

Appendix C – Reference Cases 325

Learning objectives

The objective of this chapter is to:

- Provide an introduction to the concept of project management. This includes fundamental definitions, basic project management functions, project life cycles and phases

- Review the types and influences of alternative organization structures, with respect to both the organizations within which projects are undertaken, and the organization of the project team

- Review the issues fundamental to successful project outcomes

- Review the essential elements of effective project planning and control

This overview will show how the specific planning and control techniques introduced during the course are incorporated into the project management function.

These concepts are applicable to the management of projects of any type. While specific industries and certain types of projects will often require specialist knowledge to effectively plan and control the project, the principles outlined in this course will generally apply in all cases.

The definitions and techniques presented here are generally accepted within the project management discipline. That is; their application is widespread, and there is consensus about their value.

1.1 Definitions

1.1.1 Project

Performance of work by organisations may be said to involve either operations or projects, although there may be some overlap.

Operations and projects share a number of characteristics in that they are:

- Planned, executed, and controlled

- Constrained by resource limitations

- Performed by people

Projects are, however, different from operations (such as maintenance or repair work) in that they are temporary endeavours undertaken to create a. unique product or service. Table 1.1 shows the differences and similarities between operational and project activities.

| OPERATIONAL ACTIVITY | PROJECT ACTIVITY | |

|---|---|---|

| Planned | Yes | Yes |

| Executed | Yes | Yes |

| Controlled | Yes | Yes |

| Resources consumed | Yes | Yes |

| Organization | Permanent | Temporary |

| Output | Non-unique | Unique |

The primary objectives of a project are commonly defined by reference to function, time, and cost. In every case there is risk attached to the achievement of the specified project objectives.

1.1.2 Program

A program is a grouping of individual, but inter-dependent, projects that are managed in an integrated manner to achieve benefits that would not arise if each project were managed on its own.

1.1.3 Project management

Project management is the application of specific knowledge, skills, tools, and techniques to plan, organise, initiate, and control the implementation of the project, in order to achieve the desired outcome(s) safely.

Note that ‘Project Management’ is also used as a term to describe an organisational approach known as ‘Management by Projects’, in which elements of ongoing operations are treated as projects, and project management techniques are applied to these elements.

1.2 Project management

1.2.1 Elements

Successful project management requires that planning and control for each project is properly integrated.

Planning for the project will include the setting of functional objectives, cost budgets and schedules, and define all other delivery strategies. Successful planning requires the proper identification of the desired outputs and outcomes.

Control means putting in place effective and timely monitoring, which allows deviations from the plan to be identified at an early stage. As a result they can be accommodated without prejudicing project objectives, and corrective action can be initiated as required.

A project organisation appropriate to the task must be set up, and the duties and responsibilities of the individuals and groups within the organisation must be clearly defined and documented. The lack of clear definition of structure and responsibilities leads to problems with authority, communication, co-ordination and management.

The project management procedures put in place for the project must ensure that monitoring is focused on the key factors that the results obtained by monitoring are timely as well as accurate, and that effective control systems are established and properly applied by the project team. Project management involves five basic processes:

- Initiating: Undertaking the necessary actions to commence the project or project phase

- Planning: Identifying objectives and devising effective means to achieve them

- Executing: Co-ordinating the required resources to implement the plan

- Controlling: Monitoring of the project and taking corrective action where necessary

- Closing: Formalising the acceptance of the project or phase deliverables (the ‘handover’), and terminating the project in a controlled manner

Within each of these processes there are a number of sub-process involved, all linked via their inputs and outputs. Each sub-process involves the application of skills and techniques to convert inputs to outputs. An example of this is the preparation of a project network diagram (output) by the application of the precedence method (technique) to the identified project activities (input).

1.2.2 The professional body of knowledge

Project management has developed as a professional discipline since the 1950s. It is claimed, reasonably, that the military was the first institution that adopted planning and control processes that could be characterized as formal project management – specifically for the Normandy invasion, and subsequently for the Manhattan Project. Since the 1970s there has been a sustained development of project management as a professional discipline.

There are professional project management bodies in most countries. In Australia the professional organisation is the Australian Institute for Project Management. In New Zealand it is the New Zealand Chapter of the Project Management Institute (PMI). The international body is the International Project Management Association.

In defining the knowledge base for project management it is useful to refer to the structures adopted by the PMI in the USA and the Association for Project Management (APM) in the UK. Their web addresses are www.pmi.org and www.apm.org.uk respectively.

PROJECT INTEGRATION MANAGEMENT

PROJECT SCOPE MANAGEMENT

PROJECT TIME MANAGEMENT

PROJECT COST MANAGEMENT

PROJECT QUALITY MANAGEMENT

PROJECT HUMAN RESOURCE MANAGEMENT

PROJECT COMMUNICATIONS MANAGEMENT

PROJECT RISK MANAGEMENT

PROJECT PROCUREMENT MANAGEMENT

|

PROJECT MANAGEMENT

ORGANISATION and PEOPLE

TECHNIQUES and PROCEDURES

GENERAL MANAGEMENT

|

| IIA PMI PMBOK | IIB APM PMBOK |

1.3 Project life cycle

1.3.1 Lifecycle elements

Projects proceed through a sequence of phases from concept to completion. Collectively, the separate phases comprise the project ‘life cycle’.

There are only a limited number of generic lifecycles, though the breakdown of the phases within can be at differing levels of detail. The generic types are usually considered to include capital works, pharmaceutical, petrochemical, defence procurement, research and development, and software development. Consequently the initial starting point for managing the project is to define the type, and select an appropriate life cycle model as the planning framework.

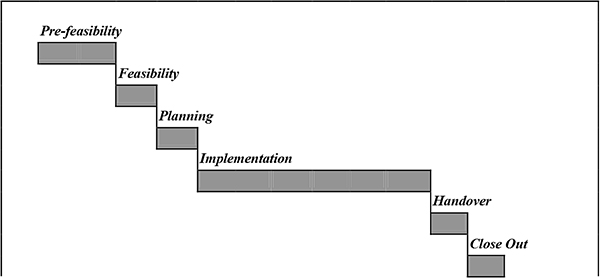

Figures 1.1 and 1.2 illustrate generic project life cycles for two project types.

Project life cycle: capital works project

Project life cycle: defence acquisition project

1.3.2 Project phases

Different industries generally have specific standard definitions for each phase, but a generic description of each phase identified in Figure 1.1 for a capital works project is:

- Pre-feasibility: Identification of needs, and preliminary validation of concept options

- Feasibility: Detailed investigation of feasibility, including preliminary brief, project estimate and investment analysis

- Planning: Detailed definition of the project with respect to scope, organisation, budget, and schedule, together with definition of all control procedures

- Implementation: The execution of the scoped project. The components of this phase will depend upon the nature of the project

- Handover: Passing the facility into the control of the principal. This includes formal handover of the facilities, user training, operating and maintenance documentation etc.

- Close out: Archiving of the project records, establishing appropriate performance evaluations, capturing and transferring lessons learned, and dissolving the project organisation

Project phases share defined characteristics.

- In every instance project management processes undertaken with a specific phase comprise initiating, planning, executing, controlling, and closing.

- A project phase will have one or more tangible deliverables. Typical deliverables include work products such as feasibility studies, software functional specifications, product designs, completed structures, etc.

- Outputs from a phase are typically the inputs to the succeeding phase

Normally, deliverables from any phase require formal approval before the succeeding phase commences. This can be imposed through the scheduling of compulsory ‘milestones’ (e.g. design reviews) between phases.

1.4 Project organizations

1.4.1 General

Where projects are set up within existing organisations, the structure and culture of the parent organisation has great influence on the project, and will be a deciding factor in whether or not there is a successful outcome. Where the project team is outside the sponsoring or client organisation, that organisation may exert significant influence on the project.

The organisation of the project team also directly influences the probability of achieving a successful outcome. The benefits and disadvantages of the various options for project team organization need to be appreciated.

1.4.2 Projects within existing organizations

Organisational structures have traditionally been defined within the spectrum from fully functional to fully project oriented. Between those extremes lie a range of matrix structures.

The classic functional structure is a hierarchy, with staff grouped within specialist functions (e.g. mechanical engineering, accounting etc.), with each staff member reporting directly to one superior. Such organisations do manage projects that extend beyond the boundaries of a division, but within a division the scope of the project is considered only as it exists within the boundary of that division. Project issues and conflicts are resolved by the functional heads.

In a project management organization the staff are grouped by project, and each group headed by a project manager who operates with a high level of authority and independence. Where departments co-exist with the project groups, these generally provide support services to the project groups.

Matrix organisations may lie anywhere between the above. A matrix approach applies a project overlay to a functional structure. Characteristics of matrix organisations may be summarised as follows:

- Weak matrix organizations are those closely aligned to a functional organization, but with projects set up across the functional boundaries under the auspices of a project co-ordinator. The project co-ordinator does not have the authority that would be vested in a project manager

- A strong matrix organization would typically have a formal project group as one of the divisions. Project managers from within this group (often with the necessary support staff) manage projects where specialist input is provided from the various functional groups. The project managers have considerable authority, and the functional managers are more concerned with the technical standards achieved within their division than with the overall project execution

- In a balanced matrix the project management is exercised by personnel within functional divisions who have been given the appropriate authority necessary to manage specific projects effectively

The different organizational structures, and the corresponding project organization options, are identified in Figure 1.3. In many cases an organization may involve a mix of these structures at different levels within the hierarchy. For example, a functional organization will commonly set up a specific project team with a properly authorized project manager to handle a critical project.

The influence of the organisation structure on various project parameters is illustrated in Figure 1.3.

While a matrix approach may be seen as providing an inadequate compromise, in reality it is often the only realistic option to improve the performance of a functional organization. It does work, but there are some trade-offs. One factor critical to the effectiveness of the matrix structure is the authority vested in the person responsible for delivery of the project. A key predictor of project performance is the title of this person i.e. whether he/she is identified as a ‘project manager’, or something else.

Briefly, the benefits and disadvantages of the matrix approach include (see Table 1.3), also see Table 1.4:

| Benefits | Disadvantages |

|---|---|

| All projects can access a strong technical base | Dual reporting structures causes conflict |

| Good focus on project objectives | Competition between projects for resources |

| Sharing of key people is efficient | There may be duplication of effort |

| Rapid responses to changes | Management and project goals in conflict |

| Individuals have a protected career path |

Project structures within organizations

| Organization type | Functional | Weak matrix | Balanced matrix | Strong matrix | Project |

|---|---|---|---|---|---|

| Project mgr Authority | Little or none | Limited | Low to moderate | Moderate to high | High to Total |

| % Personnel assigned 100% on project | Minimal | 0-25% | 15-60% | 50-95% | 85-100% |

| Project mgr Role | Part time | Part time | Full time | Full time | Full time |

| Project mgr Title | Co-ordinator/Leader | Co-ordinator/Leader | Project manager | Project manager | Project manager |

| Project mgr Support staff | Part time | Part time | Part time | Part time | Full time |

1.4.3 Project organization

The organisation of the project team is characterised by:

- The principal or project sponsor. This is the beneficial owner of the project

- The Project Control Group (PCG). In some cases this will be the principal, but when the principal is a large company it is required to identify and make accountable certain nominated individuals. The function of this group is to exercise approvals required by the project manager from time to time, controlling the funding to the project manager, and maintaining an overview of the project through the reporting process

- The project manager. In a ‘perfect world’ the responsibilities, roles and authority of this person would be defined and documented

- A project control officer or group, if this function is not undertaken by the project manager. This group of people is responsible for the acquisition and analysis of data relating to time, cost and quality, and to compare actual figures with the planned figures

- The rest of the project team, which will vary in composition according to the project type, as well as specific project variables

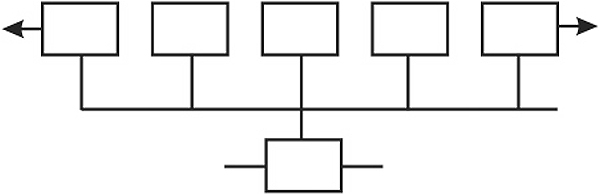

The project organization may be vertical or horizontal in nature, depending on the span of control chosen by the project manager. That choice will be a balance between available time and the desired level of involvement. Typical project structures for a capital works project are illustrated in Figure 1.4. These illustrate the difference between horizontal, intermediate, and vertical organisation structures.

In general the horizontal structure is the best option, because the communication channels between those who execute the project work and the project manager are not subject to distortion. For instance, in the vertical organisation there is a far higher probability of the project manager receiving and acting upon inaccurate information. Such inaccuracies may arise unavoidably, by oversight, carelessly, or deliberately. The impacts can be severe. Reducing that opportunity, by shortening communication channels and removing the intermediate filters, improves the likelihood of achieving the desired project outcome.

On large projects the desire to maintain a horizontal structure can be largely achieved by increasing the size of the ‘project manager’. This is typically done by augmenting the project manager with support staff that have direct management responsibilities for a portion of the project. Their interests are aligned with those of the project managers, and a higher reliability of information may be expected.

Project team organization

1.5 Project success

1.5.1 General

Many projects qualify as successes, but we all have experience, anecdotal or otherwise, of projects that have gone severely wrong. Project failures exist within all industries. Even today, with the level of awareness for project management processes as well as advanced tools, there are spectacular failures. These occur even on very large projects where it is assumed that the investment in management is high. The consequences of failure can be significant to the sponsoring organisations as well as project personnel.

A 1992 study of some 90 data processing projects, completed in the previous 12 years, provides a common profile of experience. The study identified the primary factors affecting the project outcomes as set out in the Table 1.5. These are listed by frequency and severity (ranked in descending order of impact) in respect of their negative impact on project success. This analysis provides an instructive basis for any organisation operating, or setting up, a project management methodology. Note that most of these issues are project management issues.

| Factor | Frequency | Severity |

|---|---|---|

| Planning/monitoring | 71% | 1 |

| Staffing | 58% | 2 |

| Scope management | 48% | 3 |

| Quality management | 44% | 4 |

| Communications | 42% | 5 |

| Technical | 36% | 7 |

| Management | 32% | 8 |

| User involvement | 30% | 6 |

| Implementation issues | 28% | 9 |

| Operations | 24% | 11 |

| Organization | 24% | 10 |

| Estimating | 19% | >12 |

1.5.2 Project success criteria

It is a vital step, yet one commonly omitted, to define the project success criteria before commencing planning and delivery. In other words, define what needs to be achieved if the project implementation is to be considered a success. The project stakeholders must identify and rank the project success criteria. The ‘client’s’ preferences are obviously paramount in this process, and will consider performance right through the life of the product under development as well as the factors present only during the project.

The objectives of cost, quality, and time are frequently identified as the definitive parameters of successful projects. These are a very useful measure in many capital works projects where they can be defined in advance, adopted as performance indicators during project implementation, provide a basis for evaluating trade-off decisions, and applied with relative simplicity.

However, this approach to measuring project success is necessarily only a partial assessment in almost every situation. Projects completed within the targets for such constraints may be successfully completed from the perspective of the project implementation team, but are not necessarily from alternative viewpoints such as those of the sponsors or users. In some instances projects that are not completed within some of the time/cost objectives may still be considered a success. Common project success criteria include safety, loss of service, reputation, and relationships.

The process of defining ranked success criteria provides surprising insights in many instances, and enhances project planning. During project implementation the project success criteria provide a meaningful basis for establishing project performance indicators to be incorporated within project progress reports. They are also helpful in making trade-offs, should that become necessary.

1.5.3 Critical success factors

The results of a study of the critical success factors in projects, published in the June 1996 issue of the International Journal of Project Management, proposes a framework for determining critical success factors in projects. This study classified critical success factors applicable to all project types within four interrelated groups. These are set out in Table 1.6 with examples.

| Factors related to: | Example |

|---|---|

| The specific project | Project size, complexity, technology, number of interfaces |

| The project manager and team | Project management expertise, authority, systems, personality, resources |

| The customer organization | Customer commitment, response times, knowledge |

| The external environment | Environment: social, cultural, political, economic, financial, technical |

In practice, this is a particularly important and useful framework within which critical success factors can be identified. Where necessary, these can be managed proactively in order to maximise the probability of project success.

A survey was conducted amongst members of the PM, seeking to correlate project success criteria (specified as time, cost, quality, client satisfaction, and other) against the above factors. Projects included in the survey covered construction, information services, utilities, environmental and manufacturing. The study concluded that the critical project success factors primarily arose from the factors related to the project management and project team. For each industry the project manager’s performance and the technical skills of the project team were found to be critical to project outcomes. This confirms the conclusions from the 1992 study noted earlier.

It is important to identify, within this framework, the specific critical success factors which may impact on the project. It is then the reponsibility of the project team to develop strategies to address these factors, either in the planning or in the implementation phase.

1.5.4 Critical project management issues

The skills, knowledge, and personal attributes of the selected project manager have a critical impact on the success of the project. These critical skills encompass more than just technical and project management parameters. A key element in the success of the project manager is the effective application of non-technical skills (the so-called ‘soft’ skills); including leadership, team building, motivation, communication, conflict management, personnel development and negotiation.

It is essential that the project manager, once appointed, has full control of the project within the limitations defined by the principal or project sponsor. All parties must be made aware of this single point of authority. The authority delegated to the project manager, and his/her effectiveness in exercising it, is critical. Project management structures, particularly if the project is one within an existing organisation and across functional boundaries, creates a complex web of formal and informal interactions. Lack of clarity in defining the authority of the project manager invariably leads to difficulties.

The appointment of the project manager should ideally be made sufficiently early in the project to include management of the feasibility studies. The project manager should be appointed in order to undertake the project definition. If the project manager is not involved in the project definition phase, the outputs of this phase (project plan, control procedures, etc.) must be specifically signed off by the project manager when subsequently appointed to that role.

1.6 Project planning

1.6.1 The project quality plan

“PROJECTS BADLY PLANNED ARE PROJECTS PLANNED TO FAIL”

The project planning phase is critical to the effective implementation and control of the project and the basis for project success is established during this phase. The planning undertaken at this stage is the responsibility of the project manager. The primary output from this phase is the Project Quality Plan (PQP). The basic element required to properly define the PQP is the Work Breakdown Structure or WBS.

The PQP comprises the following:

- The PQP sign-off

- The statement of project objectives

- The project charter

- The project plan

- Project control procedures

Note: here lies an inconvenience of terminology. The PQP is much more than a plan for incorporating quality into the project. There is a comnponent within the PQP that deals exclusively with quality issues per se.

1.6.2 PQP sign off, project objectives, project charter

PQP sign-off

This is a formal record of the agreement, signed by the Project Manager as well as the PCG of the PQP. It is confirmation of approval of the plan (e.g. what is to be done, when, who, at what cost etc) and the processes involved if the desired outcomes are to be achieved.

Project objectives

This is a statement defining the project objectives. The confirmed Project Success Criteria should be included, together with quantified measures. Unquantified objectives introduce a high degree of risk to the process, by reducing the ability to measure divergences at an early stage.

Project charter

Management’s commitment to internal projects (and hence the willingness to make available the required resources), as well as formal delegation of authorities to the project manager, are recorded here.

1.6.3 The project plan

The Project Plan is the master plan for the execution of the project, and provides the framework from which the implementation will develop in a co-ordinated and controlled manner. The project scope definition, programme and budget are established at this time. These provide the baseline against which performance can be measured, and against which approved changes to the project baseline can be properly evaluated. The Project Plan comprises the following components:

Scope definition

A written scope statement that defines, in appropriate detail, the scope of every project component and identifies all significant project deliverables. In this context ‘scope’ includes features and functions of products and/or services, and work to be undertaken to deliver a conforming output

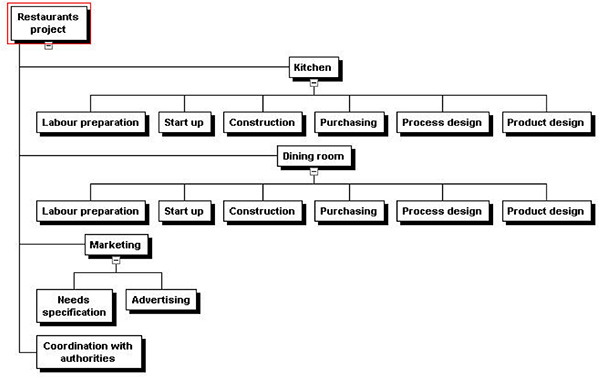

Work breakdown structure

A Work Breakdown Structure (WBS) is the breakdown of the project into the separate activities that can be considered entities for the purpose of task assignment and responsibilities. The WBS is generally presented in a product-oriented hierarchical breakdown. Successive levels include increasingly detailed descriptions of the project elements. The lowest level items are referred to as work packages and these are assignable to individuals within the project team, or to subcontractors.

Orgonization breakdown structure

The Organization Breakdown Structure (OBS) involves the definition of the project structure, setting out the parties and individuals involved in the execution of the project. It also formalizes the lines of communication and control that will be followed.

Task assignment

This is a list of the assignment tasks and responsibilities. All tasks and activities previously defined become the responsibility of specified parties. The WBS and OBS may be extended to define a ‘task assignment matrix’.

Project schedule

The preliminary master schedule for the project identifies the target milestones for the project, and the relative phasing of the components.

Project budget

In some cases a project budget is established during the feasibility study, without the benefit of adequate detail of the concepts evaluated. At that stage a maximum cost may have been established, because expenditure above that figure would cause the project not to be economically viable. Where such a constraint exists, and if the feasibility study has not reliably established the cost of the project, it will be necessary to further develop the design before committing to the project.

Miscellaneous plans

Additional plans may need to be documented here. These include, inter alia, consultations and risk management. Alternatively, a strategy for these can be defined in the section dealing with project controls.

Documentation

All of the above project elements must be documented in the Project Plan. Figure 1.5 shows the inter-relationships of all these entities.

The project plan

1.6.4 Project control procedures

The ultimate success of the project will require that objectives for performance, budget and time, as defined within the Project Plan, are fulfilled. This will only be possible if the necessary monitoring and control systems are established prior to the commencement of project implementation.

Monitoring and reporting should include project performance indicators derived from the Project Success Criteria. Planning should take into account the critical success factors, i.e. it should address any potential difficulties that may arise from them.

Control procedures need to be established and documented for the management of the following parameters:

Administration

Procedures for the administration of the project should be defined. These should include issues such as:

- Filing

- Document management

- Correspondence controls

- Administrative requirements of the principal

Scope

The definition of scope change control systems which:

- Define circumstances under which scope changes can arise

- Control the process invoked when changes do arise

- Provide for integrated management of the consequences of the changes, i.e. time and cost implications

Quality

The definition of project-specific quality policies and standards, together with processes for ensuring that the required quality standards will be achieved. This is best achieved by reference to the application of, and responsibilities for, Inspection and Test Plans.

Cost

The definition of control procedures which should include:

- Budget and commitment approvals for design, procurement and construction functions

- The issue and control of delegated financial authority, to the project manager controlling consultants and contractors, as well as to consultants controlling contractors

- Variation control for changes arising during project implementation

- Value engineering

- Cost monitoring, reporting and control systems and procedures

Time

The definition of strategies and procedures for scheduling, monitoring and reporting, likely to include:

- Programming methods and strategies for master and detail programmes, i.e. definition of programming techniques as well as the frequency of review and updating

- Progress monitoring and reporting systems and procedures.

Risk

The definition of objectives and procedures for putting in place effective risk management. Note that there may be a Risk Management activity schedule in the PQP.

Communications

This specifies all requirements for communications within the project and to the client/sponsor, and is likely to include:

- Meetings – schedules and processes

- Reporting requirements

- Document distribution

- Handover

- Close out

Procurement

This defines strategies and procedures for tendering, as well as for the selection and management of consultants, suppliers and contractors.

Tendering

This covers documented standardized tendering procedures, tender documentation, and tender evaluation procedures for each contract type (i.e. service, procurement, construction etc).

The tendering process is often a very sensitive one, especially if public funds are involved. Appropriate attention must be paid to ensure that the legal aspects of the process are properly addressed, and that the process is applied with demonstrable fairness. Recent changes in the laws applying to tendering should be noted.

Consultants

This refers to a standardized document dealing with the use of consultants. It should cover issues such as consultants’ briefs and terms of engagement. Consultants’ briefs would typically include the following items:

- The scope of the work to be undertaken, and any limitations thereon

- The type of services to be provided and the deliverables required (this will be defined within the WBS for the specific work package)

- Approvals required from the client

- Approvals to be exercised on behalf of the client

- Special requirements of a management, technical or financial nature, for example quality assurance/quality control programmes, variation control procedures etc.

- Reporting requirements

- Project schedule requirements, for service delivery as well as implementation phases

- Budgets for the proposed implementation deliverables or capital items

- Basis of payment for services to be provided by the consultant

Contracts

The terms of engagement and conditions of contract should be based on standard documents where these exist. The level of documentation should be appropriate to the values of contracts let, and usually a number of options are required.

1.6.5 Work breakdown structures

Developing the WBS is fundamental to effective planning and control for the simple reason that the derived work packages are the primary logical blocks for developing the project time lines, cost plans and allocation of responsibilities.

Many people either miss out this key step in the project management process, or undertake the step informally without appreciating how important it is.

Definition and terminology

PMI PMBOK 1996 provides the following definition for a WBS:

A deliverable oriented grouping of project elements which organizes and defines the total scope of the project: work not in the WBS is outside the scope of the project. Each descending level represents an increasingly detailed description of the project elements.

The WBS is created by decomposition of the project, i.e. dividing the project into logical components, and subdividing those until the level of detail necessary to support the subsequent management processes (planning and controlling) is achieved.

Terminology varies in respect of defining project elements. The use of the terms ‘project’, ‘phase’, ‘stage’, ‘work package’, ‘activity’, ‘element’, ‘task’, ‘sub-task’, ‘cost account’, and ‘deliverable’ is common:

PMBOK terminology provides the following definitions:

- A work package is a deliverable at the lowest level of the WBS

- A work package can be divided into activities

- An activity is an element of work performed; with associated resource requirements, durations and costs

- An activity can be subdivided into tasks

A properly developed WBS provides a basis for:

- Defining and communicating the project scope

- Identifying all components of work within the project

- Identifying the necessary skills and resources required to undertake the project

- Effective planning of the project (scheduling, resource planning, cost estimating)

The WBS does not identify dependencies between the components, nor does it identify timing for the components. These are, for example shown in the PERT and Gantt charts (see next chapter).

Creating the WBS

There are many valid approaches for the decomposition of a project. In many cases there will be semi-standard WBS templates that can be used or adapted. The WBS should generally identify both the project management and project deliverables, and should always be defined to reflect the particular way in which the project is to be managed.

The appropriate level of detail will vary between projects, and at different times within the same project. Future project phases may need less definition than the current phases – so the WBS may be progressively developed as the project develops – but this requires a flexible WBS structure to be selected in the first instance.

In planning the WBS, criteria can be adopted to ensure that the level of detail is appropriate and consistent. Such criteria might include:

- Are the packages of work in the WBS sensible?

- Can any package be broken down further into sensible components?

- Is each package the responsibility of only one organizational group?

- Does every package represent a reasonable quantity of work?

- Does any package constitute more than, say, 5% (or 10%) of the project?

- Does any package constitute less than, say, 1% (or 2.5%) of the project?

- Does every package provide the basis for effective cost estimating and scheduling?

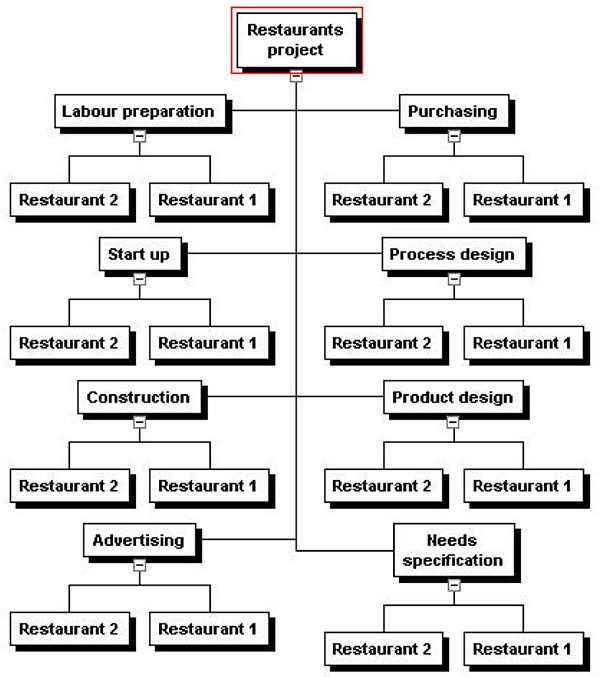

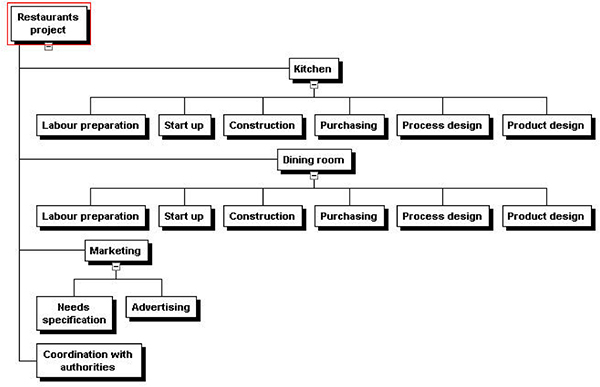

The following example shows the WBS of a project with geographical location at the second level (see Figure 1.6).

WBS for restaurants project

Alternatively, the various functions (design, build, etc) can be placed at the second level (see Figure 1.7).

Alternative WBS for restaurants project

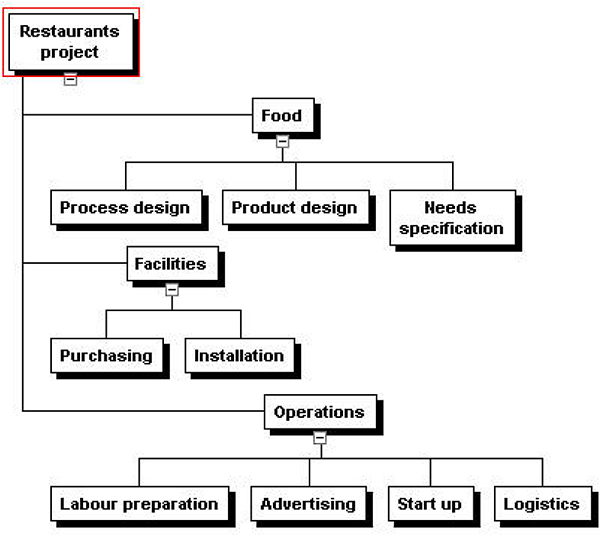

A third alternative shows a subsystem orientation (see Figure 1.8).

Alternative WBS for restaurants project

A fourth alternative shows a logistics orientation as follows (see Figure 1.9):

Alternative WBS for restaurants project

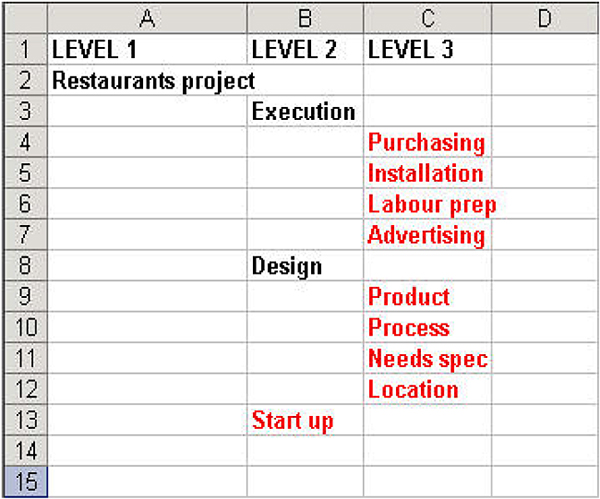

The WBS could also be drawn to show a timing orientation (see Figure 1.10).

Alternative WBS for restaurants project

Note that ‘Design’ and ‘Execution’ in the WBS above are NOT work packages, they are just headings. ‘Start up’, however, is a work package since it is at the lowest level in its branch. The WBS could be broken down even further but the risk here is that the lowest-level packages could be too small. If ‘advertising’, for example, could be accomplished in 100 hours it might be a good idea to stop at that level. It could then be broken up into activities and tasks (and even sub-tasks); the duration and resource requirements would then be aggregated at the ‘advertising’ level, but not individually shown on the WBS.

It is, of course, not necessary to use a sophisticated WBS package; a spreadsheet will work just fine as the following example shows (see Figure 1.11).

WBS using spreadsheet

Learning objective

The objective of this chapter is to provide a comprehensive introduction to the key elements of effective time management for projects. Time management of a project consists of:

- Planning the project activities to a time scale (i.e. the project schedule)

- Monitoring performance of the implementation phase

- Comparing achieved performance with the project schedule

- Taking corrective action to ensure planned objectives are most likely to be met

The level of project planning that we propose requires a significant input of time and energy at the start of the project, but considerably reduces the content and cost of management effort during the project implementation phase. The preparation of the project schedule is only the first, albeit very important, step.

Time management requires the monitoring and control functions to be carried out effectively so that the project schedule can be adhered to, or so that any variance from the plan does not prejudice project objectives.

The planning, monitoring and controlling cycle should be in process continuously until the project is completed. The project schedule should be prepared with some knowledge of the monitoring system to be employed. The prerequisite for setting up the monitoring system is the identification of the key factors to be controlled. It may be, for example, the achievement of specific milestones or particular resource items. The project manager will have to establish the boundaries within which these factors need to be constrained. Performance monitoring must focus on outputs, not inputs; i.e. results not effort.

2.1 Project planning

The principal aim of project management is to effectively utilize the available resources in order to achieve the planned objective(s).

It is most unlikely, if not impossible, that this aim can be achieved in the absence of rational planning and scheduling of all component activities, together with the associated human, material and financial resources. Particular techniques have been developed which allow this essential planning to be undertaken.

The most commonly used in the field of project management are known collectively as Project Network Techniques. These comprise:

- The ‘Critical Path’ method (also known as the Activity on Arrow or AoA method)

- The Precedence method (also known as the Activity on Node or AoN method)

The Critical Path method may be the only one many people are familiar with since it is intuitively attractive. The Precedence method appears, at least from a superficial look at the comparable diagrams, to be more complex.

However, the Precedence method is far more flexible. The Precedence method has the advantage of requiring no dummy activities to establish the correct logic for a project. Once the superficial complexity is overcome, you will find it to be the more powerful tool. Most computer-based project scheduling software packages use precedence logic and a proper understanding of the method enables the software to be used to best effect.

Precedence network analyses are normally presented graphically, either as the network diagram itself, or as a time-scaled bar chart known as a Gantt chart. Critical path networks can be presented as time-scaled arrow diagrams, or as Gantt charts. All computer-based project scheduling software packages use Gantt presentations in addition to the network diagrams.

Project analysis by either method involves the same four steps:

- Defining the activities. For the initial project plan this may involve the breakdown of work packages used as the basic elements for the other components of the PQP

- Preparation of the logic sequence to determine the relationships between the activities

- Applying activity (time and resource) data for each activity

- Analysis of the network

The following is a brief introduction to these techniques. It will, however, be sufficient to allow you to fully apply both methods to analyze any situation. There is a vast amount of literature available on the subject that could be consulted for additional guidance.

2.2 The critical path method

2.2.1 Defining the activities

The first step in project planning is to break the defined work packages into component activities, and sometimes tasks. It is crucial that this breakdown be carefully considered if the subsequent output is to be an effective project control tool.

In establishing the activity list, the following principles may assist:

- For an initial analysis the number of activities should be kept to the minimum required to be useful. This allows for the framework to be developed and checked for consistency before too much effort has been spent. If found necessary, the activities can be broken down further at a later stage if that is appropriate

- For a definitive plan it is useful to include more detail so that the schedule in the PQP can be adopted as the baseline for schedule monitoring

- Who else will be using the schedule, and for what purpose?

- Is it an appropriate master plan, allowing elements to be defined in more detail as implementation continues?

It is important to note that the word ‘operation’ or ‘activity’ is used in its widest sense. It will not only include actual physical events, derived form the work packages, but anything that may exercise a restraint on the completion of the project should be included as an activity. This will include actions such as obtain finance, obtain approval, place order, and represent passages of time with no actual activity, e.g. delivery period.

2.2.2 Preparing the logic network

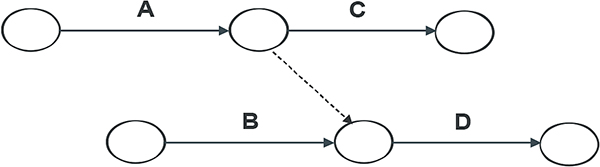

The arrow diagram

In CPM, each activity is represented by an arrow. The tail of an arrow marks the start of the activity it represents, and the head marks its finish. The start and finish of activities are called events or nodes. Circles are drawn at the tails and heads of arrows to denote the nodes. The arrow diagram, or network, is drawn by joining the nodes together to show the logically correct sequence of activities. The arrows are not drawn to scale; their lengths are unimportant at this stage. Their directions show the flow of work. Here are a few simple illustrations.

Figure 2.1 shows two sequential activities indicating that Activity B cannot be started until Activity A is completed.

Network example

Figure 2.2 shows that Activity E must await the completion of both Activities C and D before it can commence.

Network example

Figure 2.3 shows Activities G and H as concurrent activities that can start simultaneously once Activity F has been completed.

Network example

When developing the arrow diagram, three questions are asked of each activity in order to ensure its logical sequence:

- What must precede it?

- What has to follow it?

- What can take place concurrently with it?

The importance of these three questions cannot be overemphasized. Be aware of the ease of inadvertently introducing constraints by implication.

Numbering of events

All events are numbered to facilitate identification. This step is usually carried out after the whole arrow diagram has been drawn. Each activity is identified by two event numbers, e.g. as (i,j). The (i) number identifies the tail of the arrow, and the (j) number identifies the head of the arrow. The letters ‘i’ and ‘j’ are chosen at random and have no special significance, but it is advisable to use multiples of 5 or 10. The reason for this is the flexibility to introduce additional events into the network. For example, see Figure 2.4.

Activity C is identified by (15, 20), D by (20, 25) and E by (20, 30). Note that for sequential activities, such as C and D, the (j) number of the preceding activity is the same as the (i) number of the following activity.

Numbering of activities

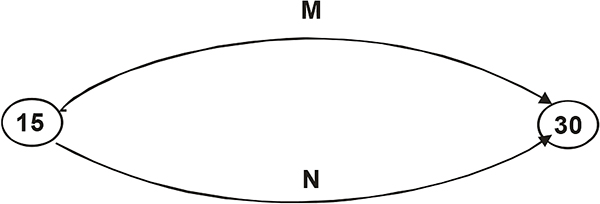

Dummies

Each activity should have a unique identification. If two concurrent activities both start and finish at the same nodes they will be identified by the same (i, j) numbers, as shown in Figure 2.5 where both Activities M and N are (15, 30).

Concurrent activities

In order to keep the identification of activities unique, a dummy activity is introduced as shown in Figure 2.6. Activity M is still (15, 30) but Activity N is now (15, 25). Activity (25, 30) is a dummy. Dummy activities are always represented by a dotted arrow.

Dummy activities

Another important use for dummies is to keep the sequence logic correct in a group of arrows where not all preceding and following activities are interdependent. Suppose we have a situation where starting Activity D depends on the completion of both Activities A and B, and starting Activity C depends only on completion of Activity A.

The logic shown in Figure 2.7 is incorrect. It introduces a non-existent restraint, namely that Activity C cannot start until Activity B is complete.

Incorrect logic

The correct logic requires the introduction of a dummy activity. Refer to Figure 2.8.

Correct logic

Overlapping activities

Unlike the conventional bar chart, no overlapping of activities is permitted in the arrow diagram. If overlapping exists between activities, then these activities must be broken down further to provide sequential activities that may subsequently be analyzed.

Figure 2.9 shows two sequential activities, indicating that Activity 2 starts after all of Activity 1 is complete.

Non-overlapping activities

For a small job, this is probably the case. For a large job, however, the two activities may overlap to some extent. This is shown by breaking both activities down into two activities, as shown in Figure 2.10.

Overlapping activities

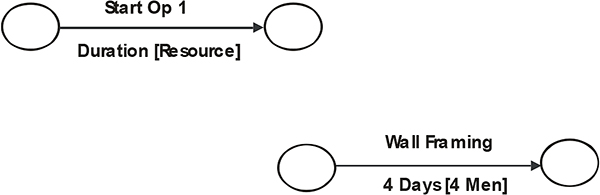

2.2.3 Adding activity data

The way in which the necessary data is included on the network diagram is very simple. See Figure 2.11. The required information is added for each activity in the network. Once all necessary activities are included, the network can be analyzed.

Activity data

2.2.4 Analyzing the network

This analysis comprises the following actions:

- adding durations for each of the activities

- adding resources for each of the activities (optional)

- analyzing the network to determine the critical path (based on the activity durations)

Adding activity durations

Durations will normally be fixed by the scheduler allocating a fixed resource for a given time. Note, however, that some computer programs calculate the duration by consideration the work content of the activity (for example, 45 man-days) and the available resources.

Time may be expressed in any convenient unit; for example, hours, calendar days, working days, weeks, months, etc.

Durations may be determined from calculations, experience, and advice. Estimates should be made on the basis of normal, reasonable, circumstances according to judgment. For a given quantity of physical work, the duration will depend on the resources allocated.

For physical activities the duration will depend on the quantity of work and the resource to be applied, the efficiency of the resource, location etc. For outside activities an allowance must be made for adverse weather.

Adding resources

Resources must be included where they are likely to be a limitation either within the project itself, or where the project competes with others for resources from a pool. See paragraph 6.0.

The critical path

The purpose of analyzing the network is to determine the critical path, and thus the total project duration. Once the network has been drawn there will, generally, be more than one path between the start and finish. The project duration for each path is calculated very simply. By adding the durations for all the activities that make up the path, various total durations will be determined. The longest of these is the time required for completion of the project. The path associated with it is, by definition, the critical path.

In many cases the critical path is obvious, or can be located by considering only a few paths, and this should be determined as a first step. If the total project duration is too long, review the planning (for example by reviewing the assumed sequencing, constraints, overlap opportunities, resources, etc) to reduce the critical path before carrying out the detailed calculations for the whole schedule.

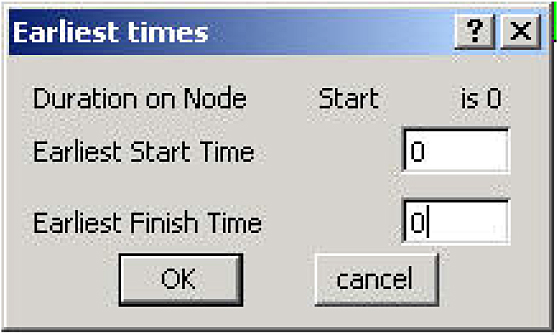

Earliest start time and earliest finish time

The Earliest Start Time (EST) of any activity means the earliest possible start time of the activity as determined by the analysis. The EST of any activity is the Earliest Event Time (EET) of the preceding node, i.e.:

ESTij = EETi

The Earliest Finish Time of an activity is simply the sum of its earliest start time plus its duration, i.e.:

EFTij = ESTij plus duration

But note that:

EFTij = EETj

The EST of an activity is equal to the EFT of the activity directly preceding it – if there is only a single precedent activity. If an activity is preceded by more than one activity, its EST is then the latest of the EFTs of all preceding activities. The logic of this should be clear: an activity can only start when all preceding activities have been completed. The latest of these to finish must govern the start of the subject activity.

ESTs are calculated by a forward pass, working from the first to the last activities along all paths. This analysis determines the EFT for the last node, and this is the minimum time for completing all activities included in the network.

Latest finish time and latest start time

The Latest Finish Time (LFT) of any activity means the latest possible time it must be finished if the completion time of the whole project is not to be delayed. The LFT for an activity is the Latest Event Time (LET) of the succeeding node, i.e.:

LFTij = LETj

The Latest Start Time of an activity is simply the sum of its latest finish time less its duration, i.e.:

LSTij = LFTij minus duration

But also note that:

LSTij = equals LETi

The LFT for the final activity is taken to be the same as its EFT. The latest times for all other activities are computed by making a backwards pass from the final activity. The Latest Start Time (LST) for any activity is obtained by subtracting its duration from its LFT. For each activity, the LFT must be equal to the LET of the succeeding node. When an activity is, however, followed by more than one activity, its LFT is equal to the earliest of the LSTs of all following activities.

The results of the analysis are recorded directly on to the network. The information displayed is the EET and LET for each node, as shown in Figure 2.12.

Results of analysis

Float

Along the critical path none of the activities will have any float; i.e. the EST for each activity will equal the LST. If any one of those activities is delayed, the completion of the whole project will be delayed.

In most projects there will be activities for which EST precedes LST, i.e. there is some float. There are distinct categories of float, of which the following two are the most relevant.

- Total float is the difference between the EFT and LFT of any activity. It is a measure of the time leeway available for that activity. It gives the time by which an activity’s finish time can be delayed beyond its earliest finish time without affecting the completion time of the project as a whole. However, using part or the entire total float of an activity will generally impact on the float available for other activities.

Total Float = LFT-EFT = LFT – EST – duration - The free float of an activity is the difference between its EFT time and the earliest of the ESTs of all its directly following activities. The significance of free float is that it gives the time by which the finish time of an activity can exceed the earliest finish time without affecting any subsequent activity.

2.3 The precedence method

2.3.1 General

The Precedence method (also known as the Activity on Node or AoN method) includes the same four steps as the Critical Path method. There are two fundamental differences between the Precedence and Critical Path methods of network analysis.

- For precedence analysis the data relating to each activity is contained on the node

- The arrows connecting the activities can show a variety of logical relationships between activities

The ability to overlap activities more easily using the Precedence method is a considerable advantage. This method gives the same results as the Critical Path method with respect to determining the critical path for the project, and the amount of float available for non-critical activities (those activities not on the critical path). It is often easier to use for people with no previous programming experience. The work breakdown is performed as per the Critical Path method.

2.3.3 Preparing the logic network

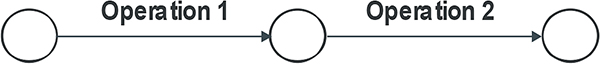

The precedence diagram

A precedence diagram is based on representing the activities. Activity data is shown within a box, and relates to the activity, as opposed to the node in the case of the CPM method. Consequently, time data is referred to as ‘earliest start date’, ‘latest start date’ etc, rather than ‘earliest event time’, ‘latest event time’ etc. Refer to Figure 2.13.

Time data

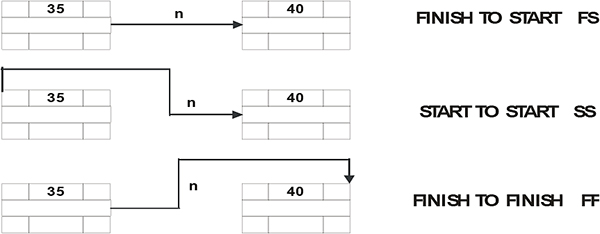

Dependencies

The logical links between activities are known as dependencies. These are generally one of the following three types as shown in Figure 2.14, i.e.

- Finish-to-start

- Start-to-finish

- Finish-to-finish

It is also possible, but rare, to have Start-to-finish dependencies.

The dependency may have a time component (shown in the following figure as ‘n’). This is known as ‘lag’. It is also be just a logical constraint.

Start-to-finish dependencies

Note that in all cases the logical relationships between A or B and other activities may well mean that other constraints control the actual start or finish of Activity B, not the dependency between A and B.

Activity constraints

The timing of activities may be constrained by factors unrelated to logical relationships between the activities. By default, analysis assumes that all activities start As Soon as Possible (ASAP type). However, the start or end date for each activity can be controlled by defining the constraint on it. If the activity constraint conflicts with the logical relationships between activities, the activity constraint overrides the logical relationship.

Activity constraints may of the following types:

- ASAP As Soon As Possible

- ALAP As Late As Possible

- FNET Finish No Earlier Than

- SNET Start No Earlier Than

- FNLT Finish No Later Than

- SNLT Start No Later Than

- MFO Must Finish On

- MSO Must Start On

Milestones

Milestones are notional activities introduced into the network to mark particular points, say, completion of each phase (e.g. completion of user definition), or achievement of a critical series of events (e.g. award of a major contract). Milestones are activities with a defined duration of ‘0’ time units. Milestones are typically used to enable higher level reporting and monitoring of the schedule.

Be aware of the fact that a milestone could involve a time-consuming design review that could take several days or weeks, in which case the milestone should be shown with an appropriate duration, or else the preceding design review must be incorporated in the project network diagram.

2.3.4 Analyzing the network

The method of determining ESD, LSD, EFD, and LFD is similar to that for the Critical Path method, although account must be taken of all defined dependency lags as well as activity constraints.

With this method it is necessary to create an artificial ‘Start’ and ‘Finish’ activity, both with zero duration. ESD and EFD are calculated by a forward pass. Calculate the ESD for each activity by consideration of preceding activities:

-

- EFDa plus n (dependency lag) equals ESDb.

The latest ESDb determined from all precedent paths is the ESDb to be used.

-

- EFDb equals ESDb plus duration.

Once the Finish task is reached, the LSDs and LFDs are calculated by a backward pass. Calculate the LSD for each activity by consideration of succeeding activities plus dependencies and durations.

-

- LFDa equals LSDb minus n (dependency lag)

The earliest LFDa determined is the LFDa to be used.

-

- LSDa equals LFDa minus duration

This is not as difficult as it sounds, but some practice is required to master the subtle aspects of more complex networks.

Example

Activity A has no predecessors, and a duration of 4 time periods (e.g. months). Activity B has no predecessors either, and a duration of 3 time periods. Activity C has a duration of 2 time periods and can only start when A is finished. Activity D is expected to take 4 time periods, and can only start when A and B is finished. The following figure shows the completed network. Note the following:

- Each activity is labeled in the middle, and the duration is shown at the top, in the centre field.

- The dummy activities ‘start’ and ‘finish’ have zero duration

Now the forward pass:

- The ‘start’ activity begins and ends at time zero (EST = EFT =0)

- Activity A can begin straight away (EST =0) and ends at time 4 (EFT =4)

- Activity B can also begin straight away (EST = 0) and ends at time 3 (EFT =0)

- C must wait for A. The earliest it can therefore start is at time 4, ending at 6 (EST = 4, EST = 6)

- D must wait for both A and B to finish and can therefore not start before 4, ending at 8 (EST = 4, EFT = 8)

- The project is only finished when D is completed, at time 8

- The ‘finish’ dummy task has zero duration, and therefore starts and finishes at 8 (EST = EFT =8)

Next follows the backward pass:

- The ‘finish’ task has zero duration, therefore its LST = LFT = 8

- Completion of C can now be delayed until time 8 (LFT = 8), so with a duration of 2 its LST is now 6

- There is no slack in C, so its latest times are the same as its earliest times

- Since the earliest D can start is 4, B need not finish before then

- A must finish by 4, otherwise it will delay D

The floats are now calculated as LST minus EFT, or LFT minus EFT, i.e. the bottom number minus the top number on either the left or the right side of each block. The critical path interconnects all those blocks with zero slack. Remember that it is possible to have more than one critical path, and that the critical path may change once the project is under way (see Figure 2.15).

AoN analysis for given example

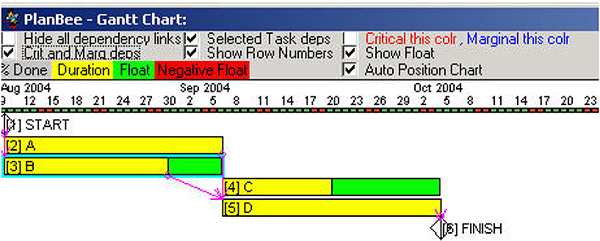

2.4 Presentation of the scheduled network

Once the EST and LFT for every activity have been determined, the network can be drawn to a time scale. This can be in the form of an arrow diagram (Critical Path method) or a bar chart, or both. Allowable float may be shown. These representations are shown in Figure 2.16.

A time-scaled bar chart is known as a Gantt chart. Probably the most useful representation of the network, particularly for managing the project, is a Gantt chart that contains all logic links between activities.

Gantt chart

The following is the result of the AoN analysis, also referred to as a PERT chart (see Figure 2.17).

PERT chart

2.5 Analyzing resources requirements

2.5.1 Resource loading

A highly valuable feature of project network analysis is the ability to generate information regarding the project resources associated with the scheduled activities. In many cases a schedule produced without consideration of the resource implications is meaningless. When reviewing construction schedules for instance, the associated resource data is always required to ensure that the planned inputs are, in fact, practical.

Useful resource analysis requires that the demand for each category of resource be identified separately for each activity. This process can be performed manually, but this can be time consuming. Computer programs used for Critical Path analysis will generally produce charts showing resource loading versus time. These are called resource histograms.

2.5.2 Resource leveling

In some project situations the total level of projected resource demands may not be a major concern, because ample quantities of the required resources are available. It may, however, be that the pattern of resource usage has undesirable features, such as frequent changes in the amount of a particular manpower skill category required. Resource-leveling techniques are useful in such situations because they provide a means of distributing resource usage over time in order to minimize the variations in manpower, equipment or money expended. They can also be used to determine whether peak resource requirements can be reduced without increasing the project duration.

Those activities that have float are rescheduled within the available float to provide the resource profile that is the most appropriate. The available float is, of course, determined by the critical path analysis which has been performed with consideration of resource requirements. During the resource leveling process the project duration is not allowed to increase.

In the case of a single resource type the process of resource leveling can be conducted manually for sizeable networks with the aid of magnetic scheduling boards, strips of paper or other physical devices. However, in situations involving large networks with multiple resource types the process becomes complicated, since actions taken to level one resource may tend to produce imbalances for other resources. In such situations the process can really only be done using a computer.

2.5.3 Constrained resource leveling

The process of resource leveling by rescheduling non-critical activities within the original project duration may not be sufficient if the resource level for one or more resources is limited. Where it is not possible to obtain all resource requirements equal to or less than the available resource levels by this process, it is necessary to extend the project duration sufficiently to allow the required resources to balance the available resources.

This process is called constrained resource leveling. Again, the process can really only be done effectively using a computer, but generally all project scheduling software programs have this feature (see Figure 2.18).

Resource analysis

2.6 Progress monitoring and control

2.6.1 Defining the plan

The effectiveness of monitoring depends on the skill with which the programmer has broken down the project into defined parcels of work. Progress is assessed by measuring the ‘percentage complete’ of individual activities during the project. If it is not possible to assess the true progress (percentage complete) of significant of significant activities, then reporting inaccuracies will be the norm and deviations will be difficult to detect. To reduce or avoid this uncertainty, each activity should be divided into stages, completion of which is both useful and measurable. This breakdown should be finer rather than coarser. Such ‘activity milestones’ must be agreed between the Project Manager and the person responsible for the specific activity at the start of the project.

The importance of this approach can be demonstrated by reference to the two scheduling scenarios shown in Figure 2.19. In each case progress can only be properly measured on completion of each activity.

Two scheduling scenarios

Assume that in both scenarios Activity A is completed one month late, at which time the problem is identified for the first time. Under Scenario I the effective rate of improvement required to complete within the original project duration is 125% (i.e. 5 periods of work outstanding with 4 periods available to complete). By comparison, in Scenario II the effective rate of improvement required to complete within the original project duration is 150% (i.e. 3 periods of work outstanding with 2 periods available to complete).

The project manager has a much greater likelihood of achieving the project time objective in the first scenario.

2.6.3 Monitoring

The project manager must be aware at all times of the actual deviance of the project from the plan. Monitoring and reporting on progress must be regular and accurate. There is no justification for the project manager not to know the precise status of the project.

The objective of the progress monitoring system is to:

- Identify areas of the project where performance is below expectations

- Provide information on such deviations from the project plan in sufficient time for corrective actions to be usefully applied

Most of the available project scheduling computer software programs allow for progress to be ‘posted’, that is, for the current status of programmed activities to be updated on the computer schedule. The network is then re-analyzed to take into account the new data, and new completion dates for the remaining activities are computed. Generally the updated schedule can be compared against an earlier baseline schedule and progress variance, both historical and future, tabulated. This baseline facility is of extreme benefit when monitoring performance.

A typical graphic progress report can provide the information shown in Figure 2.20 for each activity in the schedule.

Progress reporting

The effectiveness of the reporting is a crucial element of the project control function. A reporting format should be standardized for each project, and all progress reporting required conforming to the specified format. To provide effective control the reporting must be:

- Timely

- Accurate

- Easily interpreted

A formal report should include the following information:

- A summary of efforts and accomplishments during the reporting period

- A summary of planned efforts and accomplishments in the following period

- The status of project milestones (achieved and predicted)

- Any changes in milestones status since the previous report

- The consequences of any delays in milestones

- Desired changes in predicted performances

- Actions required/suggested/recommended to obtain desired changes, and their cost/resource implications

- In addition to the text, a graphic progress analysis clearly indicating actual versus planned progress should be included.

Progress monitoring and reporting must be a regular activity; at least monthly on projects over six months, but probably fortnightly or weekly for projects of shorter duration. Remember that the aim of monitoring progress includes the ability to take action that will allow any time lost to be regained. This may not be achievable if monitoring occurs at less frequent intervals than, say, 10 percent of the project duration.

Slippage is commonplace and should be a major concern of project managers. It occurs one day at a time and project managers need to be ever vigilant to keep it from accumulating to an unacceptable level. Slippage can be caused by complacency or lack of interest, lack of credibility, incorrect or missing information, lack of understanding, incompetence, and conditions beyond one’s control, such as too much work to do. Project managers need to be on the alert to detect the existence of any of these factors in order to take appropriate action before they result in slippage.

Project slippage is not inevitable. In fact, there is much project managers can do to limit it. The tools of progress control are the bar charts or critical path networks described above. The project manager should take the following steps:

- Establish targets or ‘milestones’ – times by which identifiable complete sections of work must be completed

- As each target event occurs, compare actual against targeted performance

- Assess the effect of performance to date on future progress

- If necessary, re-plan so as to achieve original targets or to come as near as possible to achieving them

- Request appropriate action from those directly responsible for the various activities

2.6.4 Change control

The project manager must implement a project change control procedure to provide for effective control of discretionary changes during the project, and to track non-discretionary changes. Thus, if a proposed change in scope is requested, the commitment of the change must require specific approval, given only when the cost and time impacts have been defined. In the case of unavoidable changes their impact on the project must be systematically incorporated into the project information system, especially with regard to time and cost changes.

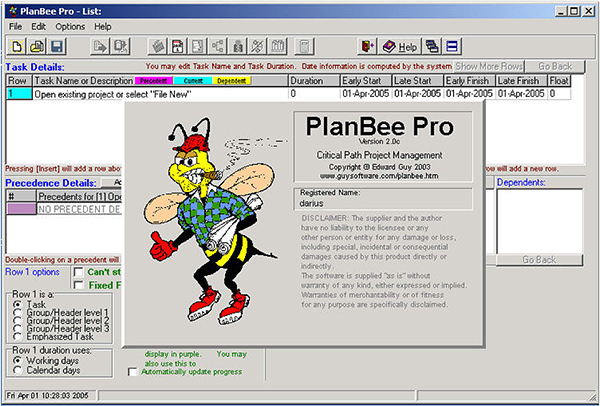

2.7 Software selection

There is a large selection of so-called Project Management software available on the market. The label is a misnomer – the software provides a tool for ‘scheduling’ projects and, in many cases, integrated cost/time management.

This does not constitute a tool with the capabilities to turn the user into an instant project manager. However, effective project management does require the use of appropriate software. The issue here is on what basis the selection of the software is made.

This is relatively simple if the program is going to be used by a number of people within the organization for low-level planning, presentation, and control of relatively simple projects. In that case ease of learning and use becomes the primary criteria. That means, for most people, a Windows-based tool with sufficient single project or multi-project capability.

In the cases where the scheduling program is required for more complex project management functions and where the cost of learning to use the software is not an issue, the basis for the selection will relate to the capabilities of the program required to suit the demands of the particular situation.

The following elements will be relevant to an informed evaluation of the best tool for a particular application.

Essential requirements

These must match the specific requirements for the required application in order to be considered for selection:

- Multi-project capability

- Number of activities per project

- Number of resources per activity

- Resource input capabilities

- Resource calendar options

- Capability to input resource and overhead costs in the form required

- Baseline capabilities for presenting update comparisons

- Presentation graphics capability and flexibility

- Flexibility to tailor cross-tab reports, particularly financial reports

Other considerations

Other issues that will be relevant to the selection include:

- Ease of learning

- Training available

- Hardware requirements

- Product support

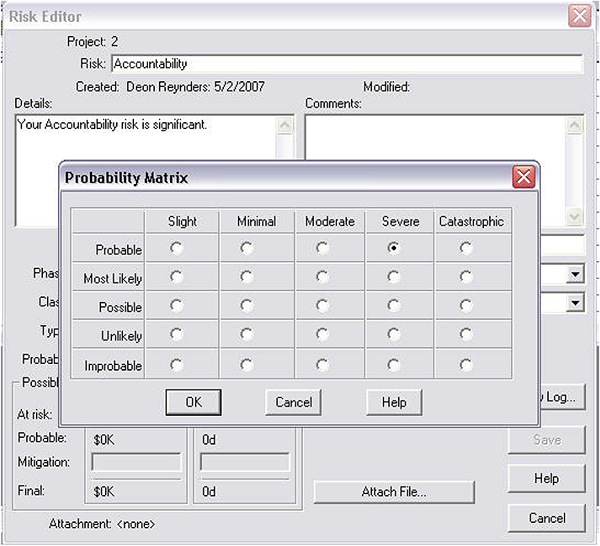

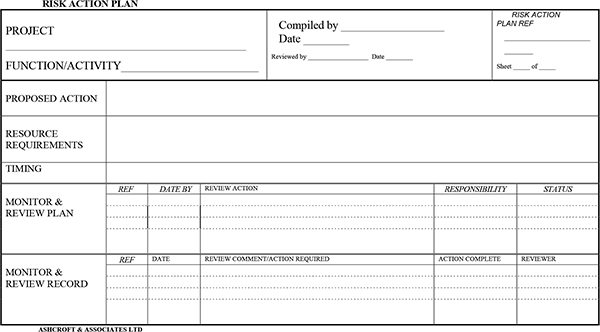

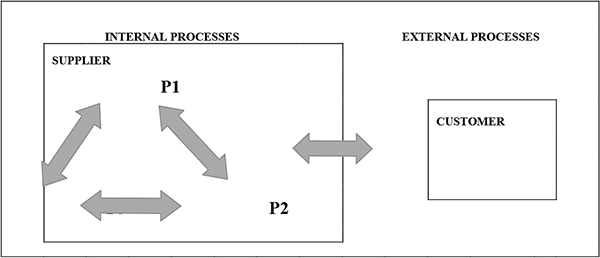

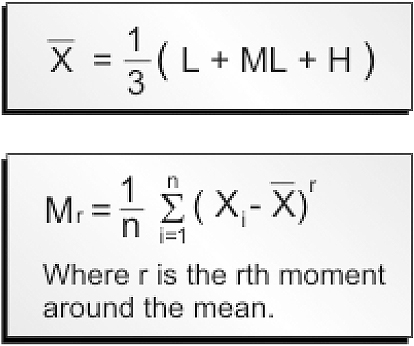

Learning objectives